Blog October 2023

Part Three: Radiant Reporting

This is the third and final article in our series about the role of technology in the property valuation process. Here we discuss how technology can improve reports and the workday of a Valuer.

iiiiiiiiii

Report writing

Automation can save time and minimise the stress that comes with the writing of reports. Natural Language Generation (NLG), a subset of artificial intelligence, can take raw data and turn it into fully formatted, natural-sounding sentences and paragraphs, mimicking the way humans write and ensuring accuracy in grammar, punctuation, and spelling.

In addition, Geographical Information Systems (GIS) can be used to identify and display relevant site maps and plans. This enables the Valuer to show data in a far more visual manner than a standard report, without the time-burden of sourcing and formatting maps and plans manually.

Report formatting

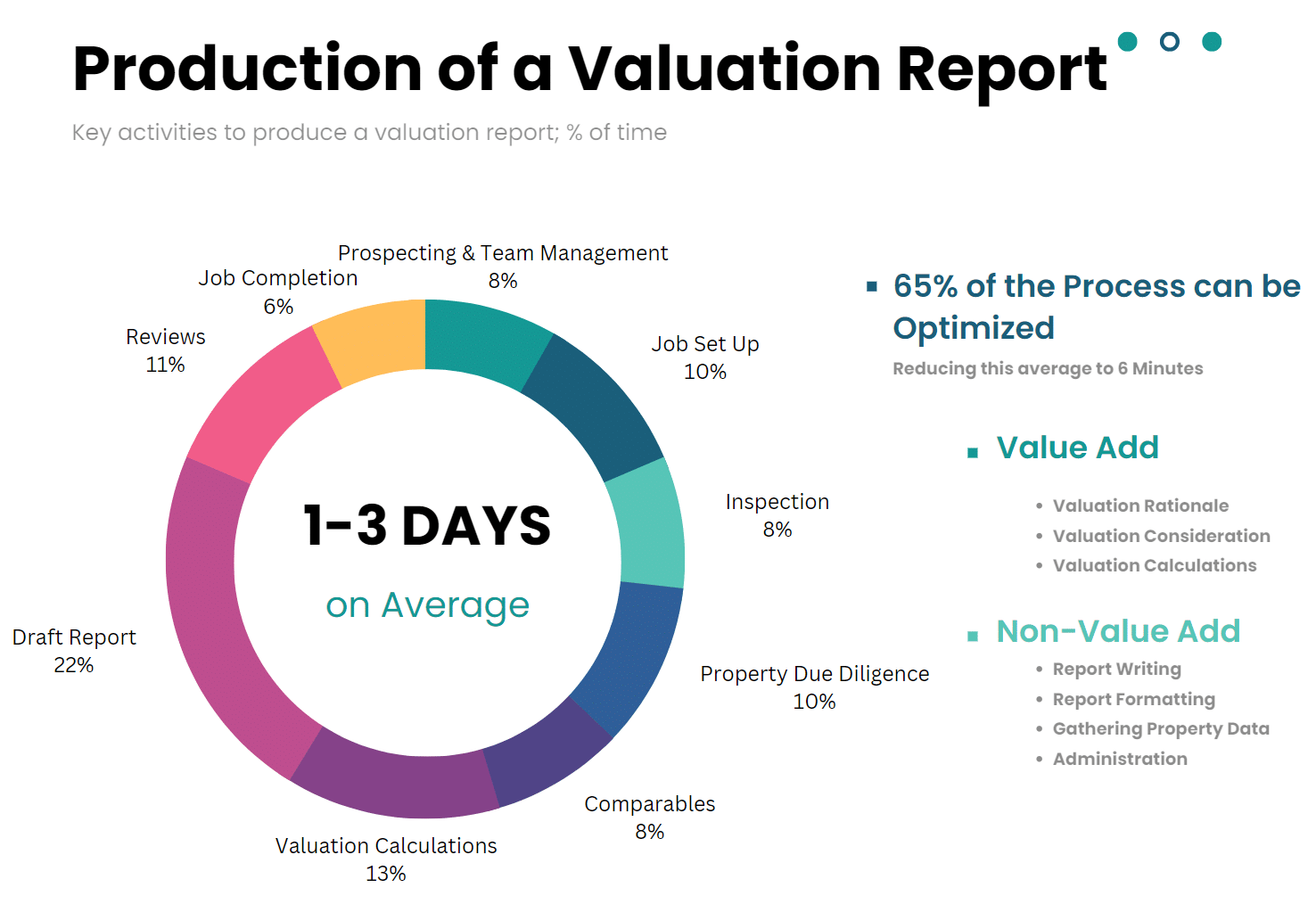

In our blog ‘Part one: The introduction of Valtech’, we shared the results of our research which showed that a whopping 65% of a Valuer’s time is spent on ‘non-valuation’ tasks. Creating, formatting, and altering report templates to ensure RICS compliance takes up a large portion of this time.

There are big time-saving opportunities here. Technological advancements now facilitate the creation of custom and dynamic templates that automatically draw from the data pipeline and insert appropriate data into the relevant sections of the report.

This means the Valuer can reduce their time spent on formatting reports and do more fulfilling tasks, resulting in a happier workday plus a quicker turnaround for their firm and client. Win, win, win!

Automating valuation reports with Valos

The very idea for Valos stemmed from our understanding, having been valuers ourselves, that there is an inherent problem in the industry; namely that the least value-add activities take the most time.

With the use of Valos, we’ve been able to show that automation of these non-valuation tasks can reduce what previously took between 1 to 3 days (three days of work) to just 6 minutes!

There are significant benefits to both Valuers and consumers. With increased productivity comes increased capacity, meaning:

- the ability to improve the quality of output,

- reduce costs,

- increase the number of jobs being undertaken, and

- drive revenue.

Previously unprofitable valuation jobs suddenly become profitable again and profit margins are improved. All good news.

But can automation do the job as well as a Valuer? There are standards which must be met and ideally, exceeded.

Can technology improve report accuracy?

Humans grow tired when performing repetitive tasks and after a certain amount of time, mistakes start to slip in as productivity and accuracy wanes. Valuers can use technology to their advantage to support them with the following:

Ensuring consistency

Automation tools such as Valos can be used to ensure consistency within the report itself, having the relevant caveats and latest regulatory updates, preventing typing errors, and eliminating the need to re-type repetitive information.

Gone are the days of providing a client a valuation report with two different values, we’ve all been there!

Identifying discrepancies

At Valos, we optimise technology to gather information from more data points than would be possible manually. For example, what once required searching on 15 different websites is all neatly packaged and fed through into one platform, where the data has passed through a data pipeline providing valuers with more breadth and depth of information.

Using technology can, therefore, increase confidence in the accuracy of data being used.

Complying with RICS Red Book Standards

As a RICS Tech Partner and a technology solution specifically designed for Valuers, Valos’ templating solution is designed to enable valuers to better adhere to Red Book standards and ensure all updates to templates are automatically delivered to every user.

Can technology improve Valuer job satisfaction?

New Valuers join the industry to value property (obviously!) but often find themselves doing a lot of administrative work. This can be a tedious and demotivating experience that ultimately leads to them leaving the profession.

For employers, this can make it difficult to recruit and retain talent. However, with the use of technology, companies can now reduce the administrative burden and make valuation work more engaging and fulfilling. Not to mention, allowing more time for building client relationships, which can also lead to enhanced customer satisfaction!

Conclusion of the role of technology

Traditional valuation processes are time-consuming and fraught with inefficiencies. We hope you agree, that technology can play a significant role in not only in driving productivity, but simultaneously enhancing accuracy and increasing employee satisfaction.

We can also conclude that technology is not here to replace Valuers’. In fact, technology can provide Valuers with more time to do the elements of the job they got into the profession to do!

If you need help in doing so, please reach out and if you liked this blog, you may enjoy our others in the series:

- Read The Role of Technology in Property Valuations Part 1: The introduction of valtech

- Read The Role of Technology in Property Valuations Part 2: Data dos and don’t bothers

Read this case study to see how technology has empowered Aitchison Raffety

- Read Aitchison Raffety driving positive change in the valuation sector with market-leading technology