Blog Sept 2023

Part One: The Introduction of ‘Valtech’

This article is the first in our series examining the role of technology in the property valuation process. It explores the introduction of technology for property valuers and identifies gaps in the modern valuation process that would benefit most from further technological integrations.

A Brief History of Property Valuation Technology

The role of technology in valuations has always centred around tools to help with two key components:

- The valuation calculation

- The collation / management of property data.

Believe it or not, technology for valuations first appeared in the 1980s. The first technology system that was created for the purpose of storing and allowing ‘online’ access of property-related data appeared in 1984. It was called ‘Focus’ and provides building information, available space, tenants, lease details, capital transactions, and planning information in the UK. When the company was sold to CoStar in 2003 it had 700 customers, including the top 20 UK real estate services firms.

In 1985, KEL Computer Systems Ltd was introduced as a residual valuation program which focused on valuation calculations. Updates were delivered by post on a 5 and quarter inch floppy disc and the most ‘tech savvy’ user within a company would run through the update process.

Since KEL’s inception, there have been several new entrants to the market to help valuers tackle the valuation calculation. For example, Circle, which was later purchased by Argus, Forbury, Aprao, CREIT Software and more recently Pantera, have all entered the market.

Life before Valtech

For many years, the best way to gather information for valuation reports relied on human interaction (a scary thought in this day and age!). Gathering comparable evidence, would require a phone call to valuers or agents of competing companies, who were almost always only too willing to share information. There was a professional code amongst valuers to share information and use it ethically.

Valuations calculations required, a thick book called ‘Parry’s Tables’ was used to determine the multiplier. With the emergence of technology, Parry’s got a new gig… it became the office doorstop, reminiscing about the glory days of being a valuer’s go-to guide.

<

<

The Optimisation Opportunity in the Valuation process

Since its initial incorporation in the valuation space 40 years ago, technology has evolved massively. Data is more readily available and tools now exist to help drive efficiency, accuracy, and improve inter and intra company communication. But whilst tech has permeated almost every aspect of the valuation process in one form or another, many of these solutions are not specifically designed for the valuer, or even the wider property sector.

Often, attempts at integration are not appropriate for the unique requirement of the valuation process, leading to a less-than-optimal fit for their needs.

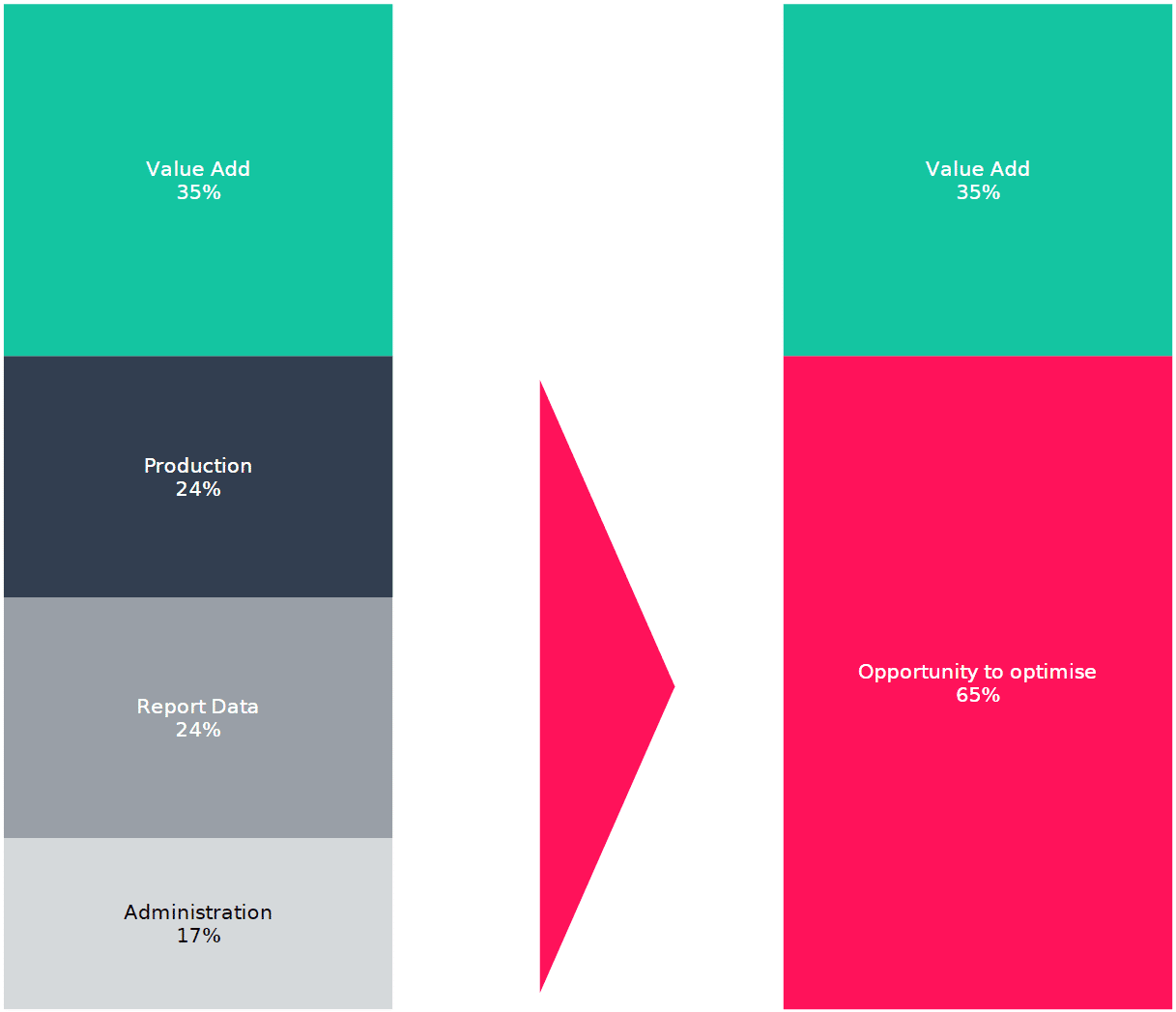

To understand where technology could have the largest impact, with the help of the research conducted by Duong Hong at Kaizen 6, we broke the valuation process down into 9 key components and analysed the amount of time valuers and support staff spent on each of these core facets.

The results of the research (below) show that the majority of valuers’ working hours are not spent analysing data and calculating value – as you might expect – but, in fact, undertaking what we might class ‘non-valuation’ tasks, which include:

• setting up the job,

• conflict checks,

• scanning government and council websites to locate and compile data,

• saving all information into an audit trail,

• creating, formatting, altering templates and ensuring they comply with The Red Book

These aspects combined, accounted for a staggering 65% of the total time spent on each valuation – representing a huge opportunity for optimisation and driving efficiencies.

<div style=”text-align: center;”></div

For a valuer that means, almost two-thirds of your time is typically being spent on tasks that fall outside your core expertise. However you feel about admin in general, it’s unlikely to be something you want to spend two-thirds of your time undertaking. And it’s certainly not what those commissioning valuations want to pay for.

So, how and where can technology be better introduced into these ‘non-valuation’ tasks to drive the efficiency of report production, improve reporting consistency and accuracy – and maybe even increase job satisfaction…? With Valos, of course! But first, do read on…

Coming soon

- Read The Role of Technology in Property Valuations Part 2: Data do’s and don’t even bothers

- Read The Role of Technology in Property Valuations Part 3: Radiant reporting

Bristol Skyline – Bristol (n.d.). DepositPhotos. Retrieved from https://depositphotos.com/photos/bristol-houses.html.