Property Valuation: Automated Property Valuations For Commercial & Domestic Premises throughout Nottingham.

Understanding More about Nottingham Property Valuation and Automated Valuation Model

For many, Nottingham acquisition comes with some level of uncertainty. A crucial step that can provide much-needed insight is a property valuation specific for Nottingham. In Nottingham, automated property valuation is becoming increasingly popular due to its speed and accuracy. This system, known as an automated valuation model or AVM, uses advanced algorithms and statistical methods to generate a property’s estimated value.

Different entities, including lenders, often rely on this automated property valuation method to ensure efficient and fair transactions throughout the Nottingham area. A valuation model like AVM reduces errors regularly found in manual methods. The process provides a detailed property valuation report, providing critical data such as the property’s estimated value and market trends. A reliable valuation report ensures all parties involved have the necessary information, eliminating potential disagreements that may arise due to discrepancies in value.

Indeed, this underscores the importance of automated valuation in today’s fast-paced real estate industry in Nottingham. High-quality valuation services are a crucial aspect of smooth and transparent property valuations. Employing automated valuation means you’re leveraging accuracy, efficiency, and insight.

Nottingham Property Valuation: More than Just Numbers and Automated Valuation

When you think about ‘Property Valuation‘, it’s more than just numbers and automated valuations. Incorporating Nottingham property listings data, a simple company number, and even dispute resolution procedures, the overall property valuation process has integrated systems and standards. Property valuations, especially in Nottingham, are fundamentally underpinned by such a professional infrastructure. The rich data sets, comprising numerical indicators enhance the reliable property valuation.

However, it doesn’t stop there. Automated valuations also play a crucial part, offering a speedier, data-based estimate of a property’s worth. While it’s easy to fall back to traditional methods, the evolution of the valuation industry is shaped by such technology and regulation. Automated valuations can provide an immediate estimate based on data from available Nottingham property listings, contributing additional layers to the valuation process, ensuring more comprehensive and effective outcomes. Property valuation, then, goes beyond numbers and automated valuation. It encompasses an integrated system of professional standards, refined data, and innovative technology.

Nottingham Property Valuations and Automated Valuation: Minimising Risk with More Accurate Reports

In the world of property, valuation can be bolstered by automated valuation, hence making property valuations not merely about numbers. The property database at hand plays a crucial role in generating an accurate property valuation report. This report, which is based on property listings data in Nottingham captured in real-time, aids in the actual completion of a property sale. Moreover, as a risk hub, it allows investors and owners to use an automated valuation model that mitigates risk.

By having an extensive property database with detailed property listings, a robust and reliable valuation model can be applied, allowing automated property valuations to be obtained. Nottingham’s property market, for instance, greatly benefits from this innovative approach.

The utilisation of accurate data consequently results in more precise reports. Correspondingly, everyone in the property market, from investors to homeowners, is safeguarded, making transactions considerably less risky. So, the next time you’re seeking a reliable property valuation or browsing through property listings, remember that automated valuation makes the process more reliable, less risky, and ultimately, more rewarding.

Further Insight on Risk Management in Nottingham Property Valuations Using Automated Valuation

In recent years, advances in technology have transformed the property market, enabling more precise property valuations. The use of automated valuation models has revolutionised traditional methods, providing instant insights and detailed property valuation reports based on comprehensive property listings data. The demand for more information and accuracy not only provides time efficiency but also reduces the risk of property investment in the Nottingham property market. Understanding how these automated tools process sales data for a wide range of properties is critical.

Through the risk hub, investors can manage and evaluate the potential risk factors associated with property investments. Here, automated valuation offers on-the-spot facts, creating a transparent and honest market scenario. This sophisticated method goes beyond just numerical data, offering more substantial insights, which are integral to a successful investment strategy. Enhanced accuracy in property valuation helps in efficient risk management, leading to profitable property trading and sales.

Data-driven automated valuation systems have emerged as game-changer tools in the property industry. By embracing this technology, users can benefit from faster, more accurate valuations, enabling smarter, data-driven decisions, and instilling more confidence in property transactions.

More Success Stories with Valos – Our Happy Property Valuation Clients

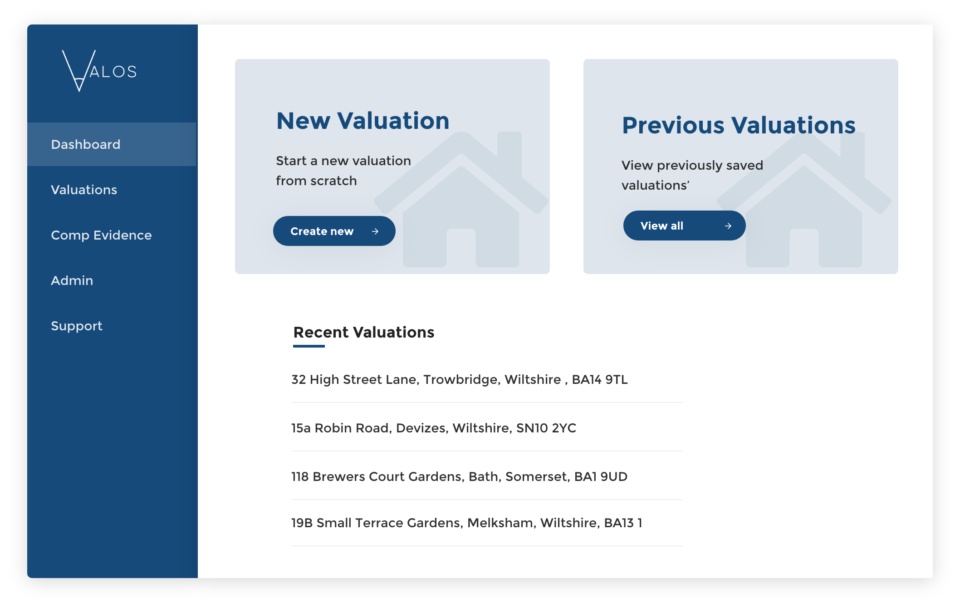

At Valos, we’ve helped many clients obtain accurate, timely property valuations using our advanced Automated Valuation Model. We’re more than just a company number, we’re a trusted partner for all your property valuation needs in Nottingham. Interested in hearing more? Let’s touch on some of our success stories. As our happy clients can verify, the value of an accurate, automated property valuation can’t be overstated.

A key is our proprietary software, tailored to evaluate a property’s true worth. By merging traditional property valuation methods with state-of-the-art technology, the uncertainty is minimised and you’ll get a valuation that’s more accurate and dependable. Our company has grown and continues to rise, thanks to our dedication to client satisfaction and our innovative approach to property valuation.

With Valos, you’re not just another number. We value our clients and the trust they place in us. Our automated valuation model is designed to bring more transparency, efficiency, and reliability into the valuation process. At Valos, we give you a more efficient valuation experience.

The Increasing Number of Happy Clients Opting for Automated Valuation for More Accurate Property Valuations

As automated valuation services continue to grow in the Nottingham property market, we’re seeing an increasing number of happy clients opt for this method – recognising it offers a level of accuracy often unmatched by traditional property valuations. Clients find the sophisticated algorithmic foundations of automated valuation offer valuable insights into both local housing and rental markets. This information is beneficial whether you’re looking to buy, rent, or understand the mortgage potential of a property.

With a property valuation report, clients attain a granular level of detail, including regular updates on sales and rental trends. This service allows for better risk management. Time is a key consideration in property dealings, and the speed of this service is another appealing factor. Clients can book a property valuation and, given our respect for privacy, be assured that their details remain confidential.

Our automated valuation solutions deliver smart and efficient surveying, contributing to a positive experience for ample happy clients. For more on our services, don’t hesitate to contact us for your property valuation needs in throughout Nottingham.

Q: What is an Automated Valuation Model (AVM)?

A: An Automated Valuation Model, or AVM, is a system that uses advanced algorithms and statistical methods to generate a property’s estimated value. This method is becoming increasingly popular in cities across the UK due to its speed, accuracy, and ability to reduce errors often found in manual valuation methods.

Q: Who uses Automated Valuation Models?

A: Various stakeholders including lenders, investors, and homeowners, often rely on Automated Valuation Models. These entities use them to ensure efficient and fair transactions by providing critical information about a property such as its estimated value and market trends.

Q: How does automated valuation contribute to the property valuation process?

A: Automated valuations offer a speedier, data-based estimate of a property’s worth. They use data from available property listings which adds additional layers to the valuation process, ensuring more comprehensive and effective outcomes.

Q: How does an extensive property database aid in generating an accurate property valuation report?

A: An extensive property database with detailed property listings allows for a robust and reliable valuation model to be applied. This leads to more accurate automated property valuations, precise reports, and ultimately, safer and more rewarding property transactions.

Q: What are the benefits of using the automated valuation system provided by Valos?

A: Valos’ automated valuation system offers accurate and timely property valuations. Clients not only obtain a detailed property valuation report, but they also experience more transparency, efficiency, and reliability in the valuation process. Furthermore, the system is designed to minimise uncertainty and maximise client satisfaction.